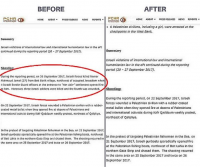

The stock rally was fluff all along. As I’ve pointed out before, there is a nearly one-for-one correlation between the S&P 500 and the trade-weighted dollar index:

S&P 500 vs Trade Weighted Dollar, Year to Date

This suggests that as US assets become cheaper, the world buys more of them. The equity market rally in part represents a shift from cash (which raised demand for dollars) into risk assets as the prospect of Armegeddon receded, and in part a shift into US assets as the global price of these assets fell.

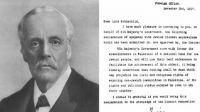

Has anything like this happened before? I know this is a bit hard to follow, but it’s the sort of exercise I find useful.

Year-on-Year Returns to S&P 500 vs. One-Year Rolling Correlation of S&P and Trade-Weighted Dollar Index Returns

We have only had one period in which the dollar and the stock market were so correlated, and that is in 1983-1984, the beginning of the great Reagan stock market rally. The world bought the dollar and sold the US economy, before the Mundell twist (tight money and lower marginal tax rates) kicked in and the Reagan recovery began. Now we have the opposite: The dollar is selling off in tight correlation with rising stock prices, again with rising stock prices.

Think of Obama as the un-Reagan: rather than a monetary squeeze hurting stocks, monetary easy is helping stocks, as the world goes to the great American fire sale assets. We’ve had an un-rally, and now it’s going undone. Analysis (specifically Granger causality) says that the dollar index leads stock prices, in case anyone cares. Some writers have noted

a relationship between monetary expansion and stock prices. The transmission mechanism, I think, goes though the currency. That is what the statistical evidence suggests.

This is a unique situation: never before has the US stock market traded as if it were a banana-republic equity market reprices to the dollar. Now the stock market is repricing to a basket of alternatives to the dollar. That doesn’t spell the end of the dollar as a reserve currency, at least not for the foreseeable future. As former Fed chairman Paul Volcker told Charlie Rose last night, there’s no alternative to the dollar. Bt that’s for now. Keep it up, and the world will eventually find a substitute for the dollar.

I still think stocks end the year roughly where they started out.