Links

Sheba Medical Centre

Melanie Phillips

Shariah Finance Watch

Australian Islamist Monitor - MultiFaith

West Australian Friends of Israel

Why Israel is at war

Lozowick Blog

NeoZionoid The NeoZionoiZeoN blog

Blank pages of the age

Silent Runnings

Jewish Issues watchdog

Discover more about Israel advocacy

Zionists the creation of Israel

Dissecting the Left

Paula says

Perspectives on Israel - Zionists

Zionism & Israel Information Center

Zionism educational seminars

Christian dhimmitude

Forum on Mideast

Israel Blog - documents terror war against Israelis

Zionism on the web

RECOMMENDED: newsback News discussion community

RSS Feed software from CarP

International law, Arab-Israeli conflict

Think-Israel

The Big Lies

Shmloozing with terrorists

IDF ON YOUTUBE

Israel's contributions to the world

MEMRI

Mark Durie Blog

The latest good news from Israel...new inventions, cures, advances.

support defenders of Israel

The Gaza War 2014

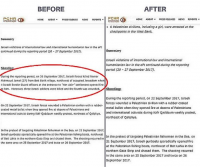

The 2014 Gaza Conflict Factual and Legal Aspects

To get maximum benefit from the ICJS website Register now. Select the topics which interest you.

US and its allies attempt to pull the rug from under OPEC

For one of the leaders of the oil-rich nation and lead OPEC member, this was some intervention. He declared, in an interview on CNN, that it would be better for oil to be at about $US70 to $US80 a barrel, more than 50 per cent cheaper than oil's high this year as the civil strife in the Middle East, the Arab spring, drove up prices on fears of supply shortages.

But Alwaleed's comments were less about the strife engulfing the region and more about the West's determination to find other supplies of energy than black gold. "We don't want the West to go and find alternatives," said Alwaleed, one of the world's richest men with a net worth of more than $US19 billion.

"The higher the price of oil goes, the more they have incentives to go and find alternatives."

But events in the past two days may see Alwaleed get his wish sooner than he could have imagined. Oil markets have been rocked by a co-ordinated push led by the US to drive down prices. As The Wall Street Journal dubbed it, US President Barack Obama has found his own coalition of the willing in a body called the International Energy Agency. Its member countries agreed to release stockpiles of oil -- more than two million barrels a day during July -- to add to the world's oil supply. The US is providing half of it from its strategic petroleum reserve, the creation of which has its origins during the oil crisis of the 1970s.

And as in the 70s, the world finds itself in dangerous economic territory.

The co-ordinated move by the IEA, which represents 28 Organisation for Economic Co-operation and Development countries, was a stunning blow to anyone betting short-term oil prices were headed higher. And like anything involving big oil, the Middle East and OPEC, the conspiracies on what it all means have been flowing thick and fast.

While Australia is part of the IEA, it did not participate in the plan, government officials say, but other countries contributing were Germany, France, Spain, Italy and Japan. The effect was immediate. Brent crude plunged as much as 7 per cent to $US107.26 a barrel on the news before recovering slightly yesterday to about $US107.88. But the falls took prices back to February and shocked the markets.

Brent had traded as high as $US127 a barrel during the Arab spring and helped drive up input prices, and thus global inflation.

"The timing of the move has oil traders scratching their heads or tearing their hair out," reported The Wall Street Journal.

"Emergency stocks are kept for use during big supply disruptions. Yet the civil war in Libya has been raging for months. Moreover, despite this month's acrimonious meeting of the Organisation of Petroleum Exporting Countries ending with no increase in quotas, Saudi Arabia said it would increase output anyway. So why release barrels now?"

The move is in fact a worrying signal as to where the world economy find itself. It comes as the International Monetary Fund warns of a slowdown in the global economy. In the past month it is as if the world economy has nudged ever closer to a global financial crisis mark II: the sovereign debt crisis in Greece threatens not only a euro-zone meltdown; the US economic recovery is in doubt and China's attempt to engineer a soft landing from a property boom and inflationary cycle is in doubt.

And with the West's fiscal and monetary responses all but exhausted after staving off the spiral from the first GFC, just how to give an extra fillip to economic growth while also trying to contain inflation has been an economic Gordian knot.

But a boost to the oil supply using strategic reserves is one trigger -- and one that has been pulled just a few times since the 70s.

"This should be considered the equivalent of a global co-ordinated rate cut," says Russ Certo, a US-based debt trader.

For Obama, facing a difficult re-election next year amid a weak economy, it's also another attempt to reinflate the US. While some optimistically hope the Arab spring could usher in an era of democratic reform and even hasten the end of OPEC and a liberation of oil markets, that is, at the very best, a long game. Obama has just over 12 months and his hope of re-election rests on a phrase that anchored Bill Clinton's success: "It's the economy, stupid."

# reads: 107

Original piece is http://www.theaustralian.com.au/business/us-and-its-allies-attempt-to-pull-the-rug-from-under-opec/story-e6frg8zx-1226081606573