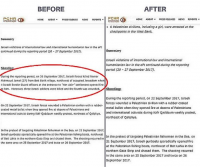

An anti-Iranian U.S. activist group is piling pressure on U.S. and European banks to dump their holding of Lebanese sovereign debt, describing Lebanon’s banking sector as a front for Iranian money laundering in cooperation with Hezbollah.

"As a result of the actions and omissions of BDL [Lebanon’s Central Bank] and the LBS [Lebanese banking system], Lebanon has become a sovereign money laundering jurisdiction that receives massive inflows of illicit deposits ... from Hezbollah’s terror and criminal activities, and the illicit symbiotic relationships among Iran, Syria and Hezbollah,” said a press release issued Tuesday by the New York-based group United against Nuclear Iran.

The press release was quoting a May 28 letter by UANI CEO Mark D. Wallace to Central Bank Governor Riad Salameh.

UANI argued that despite Lebanon’s “great risk of sovereign default” due to its high debt to GDP ratio, Lebanese sovereign bonds showed “irrational strength” that corresponds with increased pressure against Iran.

“The obvious risk of sovereign default is great – unless there is a fraudulent hidden scheme driven by Hezbollah and its state sponsors, Iran and Syria, to support this economic house of cards. There is exactly such a scheme,” the press release read.

UANI is also pushing to bar Lebanese financial institutions from participating in the U.S. financial system, urging the U.S. Treasury to designate Lebanon’s financial system as a “money laundering concern” under a statute of the Patriot Act.

The U.S. Treasury has intensified its scrutiny of Lebanon’s banks over the past few years in an attempt to crack down on Syrian and Iranian attempts to evade Western sanctions.

UANI said three financial firms have already confirmed that they have divested themselves of their holdings in Lebanese securities in recent months.

The firms are Ameriprise Financial Inc., Finland’s Aktia Bank, and Vienna-based Erste-Sparinvest KAG. The Wall Street Journal reported that Ameriprise said its decision was made before receiving correspondence from UANI. It added that HSBC and DekaBank both contacted UANI and said they also were investigating the charges raised against Lebanon.

Lebanese banks recently came under the spotlight once again after reports in the U.S. media said that four Lebanese individuals may have been involved in funding Hezbollah through illegal drug businesses.

However, the secretary-general of the Association of Banks in Lebanon told The Daily Star Tuesday that the U.S. Treasury and American financial authorities did not produce any evidence that the Lebanese banking sector was involved with money laundering activities or terrorist funding.

“There are a number of articles published in prestigious U.S. newspapers that claim that some of our banks are hoarding illegal cash or getting involved in terrorist funding. [None of] these allegations were substantiated by their authors,” Makram Sader said.

The U.S. Treasury blacklisted Lebanese Canadian Bank last year over charges of involvement in money laundering and connections to a terrorist group.

Several leading bankers have expressed their indignation over what they say is a campaign waged by U.S. newspapers to discredit the reputation of Lebanese lenders.

The country’s banking secrecy has attracted those who seek protection for their assets.

Since 2001, Lebanese authorities have tightened supervision on accounts to ensure that there are no attempts to conduct illegal activities.

For this purpose, Lebanon formed the Special Investigation Commission to investigate suspected accounts and to lift banking secrecy if the need arose.