Links

Sheba Medical Centre

Melanie Phillips

Shariah Finance Watch

Australian Islamist Monitor - MultiFaith

West Australian Friends of Israel

Why Israel is at war

Lozowick Blog

NeoZionoid The NeoZionoiZeoN blog

Blank pages of the age

Silent Runnings

Jewish Issues watchdog

Discover more about Israel advocacy

Zionists the creation of Israel

Dissecting the Left

Paula says

Perspectives on Israel - Zionists

Zionism & Israel Information Center

Zionism educational seminars

Christian dhimmitude

Forum on Mideast

Israel Blog - documents terror war against Israelis

Zionism on the web

RECOMMENDED: newsback News discussion community

RSS Feed software from CarP

International law, Arab-Israeli conflict

Think-Israel

The Big Lies

Shmloozing with terrorists

IDF ON YOUTUBE

Israel's contributions to the world

MEMRI

Mark Durie Blog

The latest good news from Israel...new inventions, cures, advances.

support defenders of Israel

The Gaza War 2014

The 2014 Gaza Conflict Factual and Legal Aspects

To get maximum benefit from the ICJS website Register now. Select the topics which interest you.

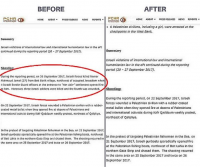

UK bank on Iran money laundering charges

The London headquarters of bank Standard Chartered, which has been accused of hiding $US250 billion in illegal transactions.

USING its New York-based operations, a British bank schemed with the Iranian government for nearly a decade to launder $US250 billion, leaving the US financial system vulnerable to terrorists and corrupt regimes, New York's top banking regulator charged on Monday.

The New York State Department of Financial Services accused Standard Chartered, which the agency called a ''rogue institution'', of masking more than 60,000 transactions for Iranian banks and corporations, motivated by the millions of dollars it reaped in fees.

Senior management at the 150-year-old bank used the New York branch ''as a front for prohibited dealings with Iran - dealings that indisputably helped sustain a global threat to peace and stability'', according to a regulatory order sent to the bank. The order requires the bank to explain the apparent violations of law in a hearing later this month and justify why its licence to operate in New York shouldn't be revoked.

Standard Chartered is accused of masking more than 60,000 transactions for Iranian banks and corporations. Photo: Reuters

The bank said on Monday night that it ''strongly rejects the position and portrayal of facts'' by the agency.

The FBI said that it had an open investigation into money laundering at Standard Chartered. In the order, regulators paint a vivid picture of a cover-up that included the code name ''Project Gazelle'', money flowing to Iran's central bank, US executives warning of ''criminal liability'', and a manual that taught employees how to automate the masking of a rising number of illegal transactions.

The accusations against Standard Chartered come as US officials work to crack down on the flow of money to foreign countries, companies and individuals connected to terrorism, weapons of mass destruction and drug trafficking.

Beyond the dealings with Iran, the banking regulator said it had discovered evidence that Standard Chartered operated ''similar schemes'' to do business with other countries under US sanctions, including Burma, Libya and Sudan.

Earlier on Monday, a spokesman for Standard Chartered said the bank was reviewing its ''historical US sanctions compliance and is discussing that review with US enforcement agencies and regulators''.

But the order accuses senior executives at the bank of suppressing complaints.

The Department of Financial Services, led by Benjamin Lawsky, said it was ''impossible to know'' how much of the money might have been used by Iran to finance its nuclear program or to support terrorist organisations.

# reads: 80

Original piece is http://www.theage.com.au/business/world-business/uk-bank-on-iran-charges-20120807-23seq.html