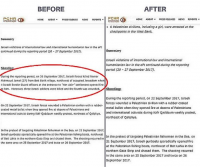

Standard Chartered Plc will comply with a New York Department of Financial Services demand that the bank hire an outside monitor to ensure compliance with US anti-money laundering laws, according to a person familiar with the matter.

The agreement on the monitor, mandated by the regulator in an August 6 order, stems from negotiations between the bank and state officials ahead of a Wednesday hearing at which Standard Chartered will be asked to explain why its licence to do business in New York shouldn’t be revoked.

New York banking superintendant Benjamin Lawsky alleged London-based Standard Chartered flouted US banking laws by helping launder about $250 billion (Dh918.3 billion) in Iranian funds in contravention of US statutes and without proper disclosure. Lawsky is said to seek as much as $700 million to settle the investigation, another person familiar with the case said.

The regulator’s threat panicked the bank’s investors, sent its share price down about 16 per cent the day after, and provoked a defiant response from Standard Chartered chief executive officer Peter Sands, who said the vast majority of wire transfers identified by Lawsky complied with federal law. The bank’s stock is down about 10 per cent for the week.

Article continues below

According to the terms of the order, the state regulator will select the monitor, and the bank will pay for it and provide access to all compliance and transaction records.

Outside monitor

Lawsky hasn’t yet decided which outside monitor should be hired, the person familiar with the requirement, who declined to be identified because the discussions are confidential, said.

The loss of Standard Charter’s New York licence would significantly damage the bank’s corporate banking model and could result in a 40 per cent drop in earnings, Chirantan Barua, an analyst at Sanford Bernstein Research in London, said. Barua has had an underperform rating on the stock since at least March, according to data compiled by Bloomberg.

Standard Chartered fell 2.7 per cent yesterday to 1,326.50 pence in London trading. The bank, which had $17.6 billion in income and $5 billion in profit last year, has $40.8 billion in assets associated with its New York branch, according to Lawksy’s order.

As part of an alleged decade of deception, Lawsky asserted in his order that Standard Chartered withheld information about banking transactions for Iranian clients from 2004 to 2007 based on advice given by Deloitte & Touche, an outside consultant.

Jonathan Gandal, a spokesman for Deloitte, said in an emailed statement that “Deloitte FAS had no knowledge of any alleged misconduct by any Standard Chartered Bank employees and categorically denies that it aided in any way any violation of law by the bank.”

Regulator’s discretion

The New York regulator has grounds to shut Standard Chartered in the state even if he accepts the firm’s argument that it illegally laundered only a fraction of the $250 billion he claims. As the state’s top banking regulator, Lawsky has power to act in his discretion against any financial institution he deems untrustworthy, according to the charter of his year-old department.

The $700 million settlement figure he is said to be considering would match the amount HSBC Holdings Plc set aside last month to resolve allegations of similar behaviour.

Since Lawsky’s order, Standard Chartered has focused its defence on the amount it laundered, saying it involved less than 1 per cent of the 60,000 Iranian wire transfers asserted by Lawsky.

Even if Standard Chartered’s position is legally sound, the order’s disclosure of internal emails suggesting a conspiracy to hide the identity of Iranian clients from regulators has given Lawsky grounds to act, according to legal experts.

Standard Chartered’s emails, cited by Lawsky, provide suitable grounds for his action, Owen Watkins, a partner with the London law firm Lewis Silkin, said.

“Making and publicising the order was within the power conferred on Lawsky by section 39 of the New York Banking Law,” Silkin said. “On the basis of the order, you can see that the superintendent has an arguable case, with the emails and the comments made by certain Standard Chartered staff internally.”

Coordinated approach

Standard Chartered CEO Sands said on August 8 that the normal practice in resolving such allegations is a “coordinated approach by the different agencies.”

As of August 8, the US Treasury Department, which has ultimate jurisdiction over whether Standard Chartered’s wire transfers complied with the law, said it was coordinating its efforts with other regulators in the case, which include the Federal Reserve, the Justice Department, the New York District Attorney, and Lawsky’s department.

Even if the coordination leads nowhere and Lawsky ends up taking action against Standard Chartered alone, the arguments presented in his order, and Standard Chartered’s history with the New York banking supervisor, suggest he would be on firm ground.