Links

Sheba Medical Centre

Melanie Phillips

Shariah Finance Watch

Australian Islamist Monitor - MultiFaith

West Australian Friends of Israel

Why Israel is at war

Lozowick Blog

NeoZionoid The NeoZionoiZeoN blog

Blank pages of the age

Silent Runnings

Jewish Issues watchdog

Discover more about Israel advocacy

Zionists the creation of Israel

Dissecting the Left

Paula says

Perspectives on Israel - Zionists

Zionism & Israel Information Center

Zionism educational seminars

Christian dhimmitude

Forum on Mideast

Israel Blog - documents terror war against Israelis

Zionism on the web

RECOMMENDED: newsback News discussion community

RSS Feed software from CarP

International law, Arab-Israeli conflict

Think-Israel

The Big Lies

Shmloozing with terrorists

IDF ON YOUTUBE

Israel's contributions to the world

MEMRI

Mark Durie Blog

The latest good news from Israel...new inventions, cures, advances.

support defenders of Israel

The Gaza War 2014

The 2014 Gaza Conflict Factual and Legal Aspects

To get maximum benefit from the ICJS website Register now. Select the topics which interest you.

The siege of Baghdad and China’s rise

Historians disagree as to whether the Mongols used cannon or counterweighted catapults, but in any case the bombardment breached the city's walls within three weeks, and they proceeded to slaughter between 200,000 and a million of its inhabitants. There are various accounts of how al-Musta'sim died, some quite colorful.

Like the Abbasids, Americans have no idea what is about to hitthem. We are a disruptive, bottom-up economy driven by entrepreneurship, and we look with contempt at China's clumsy, top-down model. The trouble is that we haven't done much innovation since the 1980s. A new generation of well-educated and eager Chinese may assimilate our past innovations and pass us by.

As a culture, to be sure, the Mongols had no capacity for technological innovation. They didn't need it. After they conquered Persia, the source of the best available siege technology in the 12th century, the Mongols employed Persian catapults hurling 100-kilogram missiles to reduce the walls of Chinese cities. By the time they turned their attention to Mesopotamia, they commanded Chinese technology as well. China, of course, was the great technological innovator of the age. Between 800 and 1200 CE, it invented gunpowder, firearms, explosive bombs, moveable type, and the magnetic compass.

China's inventiveness ended after the Mongol conquest, and the European powers who began their industrial development with borrowed Chinese technology humiliated the Middle Kingdom. China's dirigiste economy remains ill-suited to innovation. Like the 13th century Mongols, though, the Chinese don't need to innovate. They simply need to assimilate available technologies. China's multi-trillion-dollar bid for foreign technology is the most important change in world investment patterns since America's great wave of innovation of the 1980s.

A case in point is the transfer of nuclear power plant technology - once the crown jewel of American engineering - to Japan with Toshiba's acquisition of Westinghouse, and by Toshiba's license to China. Toshiba-Westinghouse and China's State Nuclear Power Technology Corporation announced a joint venture last year to develop a state-of-the-art pressurized water reactor based on Westinghouse technology. China plans to export the reactors globally.

According to Professor Yiping Huang of Peking University, writing in the September 2012 issue of East Asia Forum, what we have seen to date is only the beginning:

Chinese outward direct investment is a relatively new phenomenon. In 2002, the first year after China's accession to the World Trade Organization, China's total ODI [outward direct investment] was less than US$3 billion. By 2010, however, it had already increased to more than 20 times this amount. According to forecasts by economists at the Hong Kong Monetary Authority, if China does liberalize its capital account, Chinese ODI stock could rise from US$310 billion in 2010 to US$5.3 trillion by 2020. If this prediction turns out to be correct, then China may well become the world's largest outward direct investor by this time.To put this enormous number in context: US$5.3 trillion in overseas direct investment by China during the next seven years is roughly equal to the last three years' worth of private nonresidential fixed investment in the United States. Not all of this will acquire technology, to be sure. There isn't $5 trillion of tech companies worth buying. A great deal of China's foreign investment will reflect portfolio diversification by individual Chinese, who still cannot acquire foreign assets directly, and much of it will buy raw materials.

Most American China watchers mistook a house-cleaning last year for a crisis. China's economy seemed to stall, with exporters idling their factories and property prices falling. For a few months early in 2011 it seemed that Chinese industrial production might even be shrinking. In fact, the Chinese Communist Party deliberately cut off credit to less-efficient private manufacturers.

Nothing in China is ever quite private; the dependence of private entrepreneurs on the state is such that some state participation is always present. That is an invitation to corruption and inefficiency, and the Communist Party decided to concentrate resources on large state-owned enterprises in order to keep its friends close and its enemies closer. The short-lived credit crunch was a kind of anti-corruption campaign. [1]

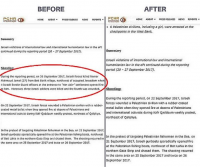

Exhibit 1: Chinese state-owned enterprises (in GXC) outperform Shanghai Composite Index

That explains why large-capitalization Chinese companies - almost all of them state-controlled - performed so much better on the stock market than the aggregate market index. Shown above is the stock price performance over the past 12 months of the Shanghai Composite Index versus the GXC, the large-cap China exchange-traded fund. The large cap, state-controlled stocks began to rally in September while the overall index was still in decline, and outperformed the overall index by a wide margin.

China's deep pockets can source whatever technology the country requires. Can the Chinese put it to effective use?

In 2008, I observed that 35 million young Chinese were studying classical piano, not counting the string players, and almost entirely with private tuition. "The world's largest country," I wrote, "is well along the way to forming an intellectual elite on a scale that the world has never seen, and against which nothing in today's world - surely not the overbred products of the Ivy League puppy mills - can compete. Few of its piano students will earn a living at the keyboard, to be sure, but many of the 36 million will become much better scientists, engineers, physicians, businessmen and military officers." [2]

In the meantime we are beginning to see data about the quality of China's students. The National Center for Education Statistics reports that in the Shanghai region of China, more than 50% of all secondary students scored at level 5 or above on the PISA mathematics proficiency tests. That compares to just 12.7% for the OECD average.

Exhibit 2: Percentage of students performing below Level 2 and above Level 5 on PISA mathematics proficiency tests in 2009

Source: National Center for Education Statistics

Students in Shanghai, to be sure, are likely to be better educated than students from the countryside, but the extremely strong showing there is indicative of where China is headed. After the Cultural Revolution, China's university system was in ruins. In its aftermath, few doctoral degrees were awarded. Now the rate has caught up with the United States. We do not have accurate data on the distribution of degrees by field, but the vast majority of American doctorates are in non-STEM (science, technology, engineering, and mathematics) fields, whereas China concentrates on STEM.

Exhibit 3: Number of doctorates awarded in China

Source: Infonomics Society

The quality of Chinese engineering PhDs also remains to be tested. But there is no question that the Chinese labor force of 2012 bears little resemblance to the largely unskilled labor force of a dozen years ago. The world has never seen anything like the present wave of young, educated Chinese entering the job market.

China does not nurture disruptive innovators. The brightest and most engaging Chinese students one meets at American universities complain about the stultifying intellectual climate at home. That is beside the point. America hasn't nurtured much innovation lately.

In the aftermath of the United States' response to Sputnik, the US had an eruption of innovations: the microprocessor (invented in 1971), the LCD display (1971), the word processor (1972), video games (1972), laser printers (1975), the spreadsheet (1978), personal computers (1981), digital cell phones (1988), the World Wide Web (1990), among others. These items are picked from the inventors' timeline page at About.com.

What has America invented since 1991? Again, according to About.com, the big items are: the digital answering machine, Web TV, the gas-powered fuel cell, the hybrid car, and, of course, Viagra. According to Professor Robert Gordon of Northwestern University, the world is simply out of ideas; the digital revolution has come and gone, and a technological trough is inevitable.

That ain't necessarily so. There's no technological trough in Israel, where innovations like the Iron Dome anti-rocket system get the full attention of the country's best minds. That's a matter for a longer discussion on a different occasion.

There is a simple way to measure the expected rate of disruptive innovations from America's high-tech companies. That is the volatility (rolling standard deviation of returns) to the information and technology subindex of the S&P 500 index, versus the volatility of the index itself.

Exhibit 4: Volatility of Information Technology Index vs S&P 500

Source: S&P, author's calculations

During the disruptive 1990s, the volatility of information technology companies was two to three times that of the overall index. Since 2007, though, the volatility of the tech sector has tracked index volatility with almost no deviation. Companies that offer disruptive technologies should be more volatile: their stock prices will rise sharply if they succeed, or crash if they fail. The fact that tech-sector volatility has disappeared tells us that investors no longer expect them to do anything disruptive.

In short, the United States does not have a tech sector. It has mature consumer businesses operating under the technology label. They walk like mature consumer businesses, quack like mature consumer businesses, and fly like mature consumer businesses. They are run by patent lawyers rather than engineers.

One might have expected more tongue-wagging after Israel's Iron Dome system leapfrogged the contending American entries. The Wall Street Journal reported on November 26, 2012:

At the direction of a White House working group headed by then-National Security Council senior director Dan Shapiro (who today is the US ambassador to Israel), the Pentagon sent a team of missile-defense experts to Israel in September 2009 to re-evaluate Iron Dome. The decision raised eyebrows in some Pentagon circles. Iron Dome was still seen as a rival to the Phalanx system, and previous assessment teams had deemed Iron Dome inferior.Israel, with seven million people, did a better job than the United States in a critical field of advanced military technology. That should have prompted hand-wringing and gnashing of teeth. In 1957, after all, the mighty Soviet Union got the jump on America by sending Sputnik into orbit, and the US responded with an all-out mobilization of resources. Today, Israeli engineers beat the Pentagon from a standing start two years ago, and we read it in the jump page of the Wall Street Journal account.

In its final report, presented to the White House in October, the team declared Iron Dome a success, and in many respects, superior to Phalanx. Tests showed it was hitting 80% of the targets, up from the low teens in the earlier US assessment. "They came in and basically said, 'This looks much more promising ... than our system,'" said Dennis Ross, who at the time was one of Mr Obama's top Middle East advisers. [3]

The decline of the US is by no means inevitable. But its first stage is already underway. Unless the United States manages to create the sense of national purpose it had when Sputnik went up, it may become irreversible. The notion that America can somehow punish China through trade sanctions is silly. The only way to keep ahead of China is to innovate. By any other means, resistance is futile.

Notes:

1. The Chinese government did not announce this, of course. I backed this analysis out of an analysis of Chinese stock returns and balance sheet characteristics. See "Liquidity is King in China" (Macrostrategy), August 16, 2012.

2. China's six-to-one advantage over the US, Asia Times Online, December 2, 2008.

3. Israel's Iron Dome Defense Battled to Get Off Ground, Wall Street Journal, November 26, 2012.

# reads: 120

Original piece is http://www.atimes.com/atimes/China/OA08Ad01.html